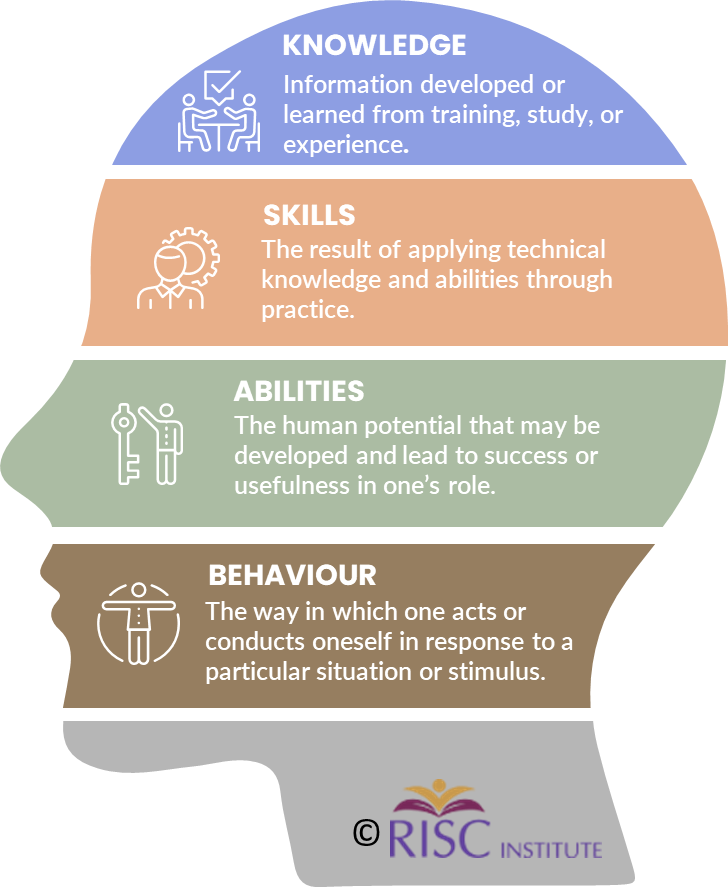

Competency is commonly defined as the knowledge and skills that individuals must have to perform effectively at work. Our series of INSURANCE COMPETENCY TRAINING COURSES are designed to develop such competencies in the participants according to their role and career progression. Each of our short courses has been specifically designed to address a focused set of competencies giving the employer the flexibility to target specific competency gaps.

- Key features

- Flexible learning formats to accommodate business needs.

- Courses delivered by experienced trainers and qualified professionals with extensive industry experience.

- Face-to-face or live virtual classes with extended learning through e-learning activities and resources.

- From 6 to 24 hours duration depending on subject matter.

- Audience levels: Novice(1), Technician (2), Specialist (3) and Key Functionary (4).

- Certificates of completion and digital badges awarded based on course performance.

RISC Institute’s Certificate courses are permitted by the Knowledge and Human Development Authority in Dubai. The qualifications granted by RISC Institute and certified by KHDA shall be recognized in the Emirate of Dubai by all public and private entities for all purposes.

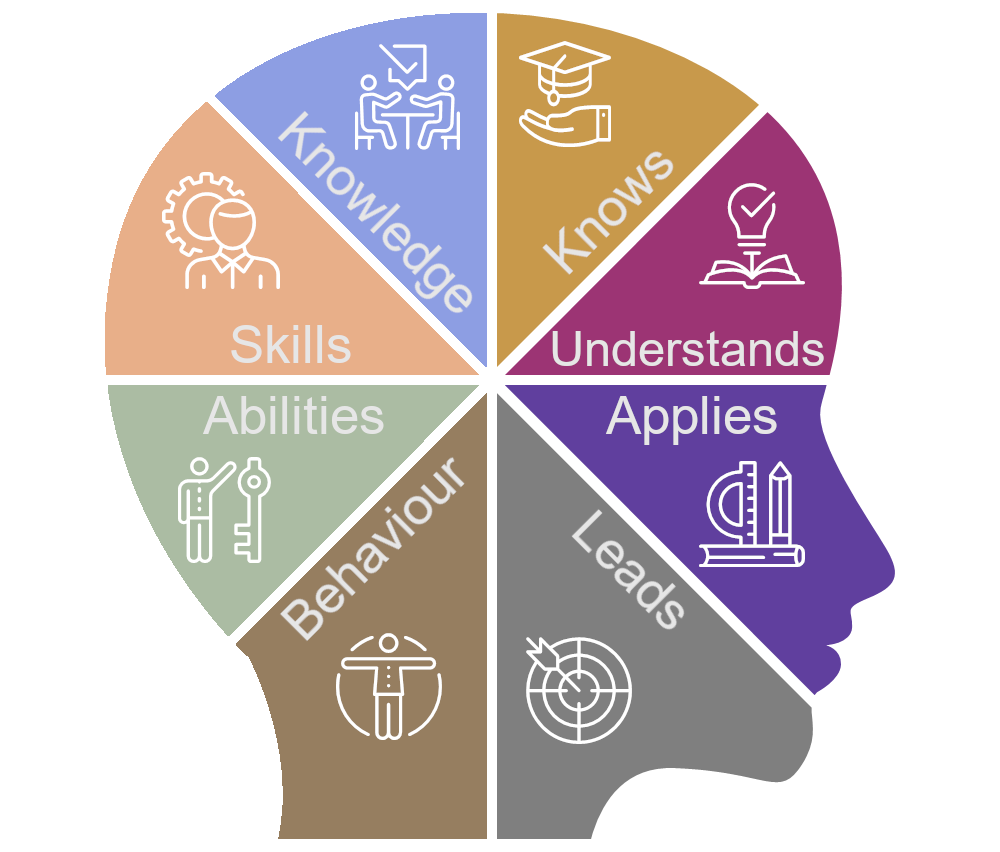

Our Insurance Competency Courses are aimed for all levels of staff in the insurance sector. Each course is designed for participants to achieve a competency level from Novice (1), Technician (2), Specialist (3) and Key Functionary (4).

The learning objectives of each of our courses are designed and developed to address a set of competencies that are to be achieved by the learners.

To assist L & D managers to evaluate and identify competencies required for each job-holder to fulfill his or her role successfully, RISC has developed a competency framework for insurance firms. This documented framework can be adapted for the organization's specific requirements and a training plan can be tailored for each individual to achieve such competencies and plan the individual’s career progression.

Contact us to request a copy of our RISC Insurance Competency Framework.

To assist L & D managers to evaluate and identify competencies required for each job-holder to fulfill his or her role successfully, RISC has developed a competency framework for insurance firms. This documented framework can be adapted for the organization's specific requirements and a training plan can be tailored for each individual to achieve such competencies and plan the individual’s career progression.

Contact us to request a copy of our RISC Insurance Competency Framework.

The objective of RISC Insurance Competency Training courses is to certify that each particpant has achieved a level of competence that enables him or her to perform her role. For this purpose, a formative assessment is conducted during the course.

The goal of this formative assessment is to monitor the trainees' learning and provide ongoing feedback, thus helping them to improve their understanding and achievement the learning objectives as the course progresses.

Moreover, the trainer also receives immediate feedback at the end of each learning objective. This helps him/her recognize where students are struggling and reinforce the learning immediately.

Data for the formative assessment is collected through four points to monitor each trainee's progress.

Where the group is sponsored, the feedback on each trainee’s participation and achievement of the learning objectives is provided to the sponsor.

The goal of this formative assessment is to monitor the trainees' learning and provide ongoing feedback, thus helping them to improve their understanding and achievement the learning objectives as the course progresses.

Moreover, the trainer also receives immediate feedback at the end of each learning objective. This helps him/her recognize where students are struggling and reinforce the learning immediately.

Data for the formative assessment is collected through four points to monitor each trainee's progress.

- Multiple Choice Quizzes during the sessions. These cover testing for prior learning, critical thinking and achievement of learning objectives. Each particpant submits their answers using their own devices logged into our audience response system during the live classes or through the interactive feature in our pre-recorded video lessons for self-paced learning. Answering attempts as well as correct scores are recorded.

- Attendance and Particpation. In addition to correct answering of the quizzes, we monitor answering attempts to record particpation and attendance.

- Completion of learning resources and activities on our LMS. The learner's completion of activities and use of resources is recorded in their gradebook on our LMS.

- Online Engagement and Particpation. If the sessions are held online, a report is extracted from Microsoft Teams at the end of each session that provides the interactions and engagement of each participant during the sessions.

Where the group is sponsored, the feedback on each trainee’s participation and achievement of the learning objectives is provided to the sponsor.

Printable Digital Certificate/Cobranded Printed Certificate

A certificate of completion is awarded to participants’ who successfully achieve the required grades. Passing grades are determined based on the mean and the median scores of the class. "Certificates permitted by the Knowledge and Human Development Authority, should be recognized by any public or private entity in Dubai"

RISC Digital Badges

RISC’s digital badges are a verifiable way to share your accomplishments with others. Digital badges can be shared via social media, email signatures, or digital business cards.How much time you need to dedicate

The duration of each course depends on the breadth and depth of the learning objectives. RISC's Insurance Competency Training can be as short as a 3 hour session focusing on a specific learning gap or up to 30 hours.

Online courses are scheduled in 3 hour sessions, usually on consecutive weekdays from 08.30 to 11.30 Gulf Standard Time.

Face-to-face courses are scheduled in 6 hour consecutive days.

We have grouped our Insurance Competency Training courses according to the functional areas of knowledge and skills required for all roles within the insurance sector. Below are the categories Click the category to see the summary of the learning outcomes and list of courses under each category.